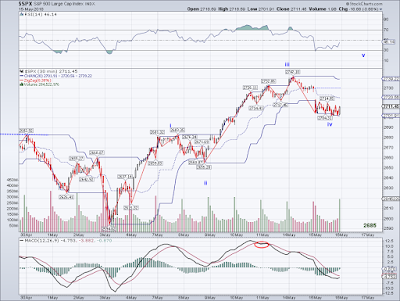

Prices headed down today to close again below the TA but unless we see selling pressure continue the market could be setting itself up for a rally. The level for bears to break is 2676, anything short of that will result in a strong bullish wave in the next week or so. I am surprised prices didn't drop as much given the tariff announcements by Trump. Maybe the market is starting to get used to his unpredictability.

Short Term Trend = Bearish trend being challenged

Medium Term Trend = Bullish trend being challenged

Long Term Trend = Bullish

* Trends are not trade signals. Trends are posted for situational awareness only and does not take into account wave counts, technical or fundamental conditions of the market. While mechanically trading the posted trends is feasible, keep in mind that these are lagging indicators and as such are prone to whipsaws and I personally do not use nor recommend them to initiate or close positions in the market without taking